Income Tax Slabs India 2025: Who Really Pays Zero Tax? (Complete Guide in Hindi)

Introduction: Clear the Confusion About Zero Tax Claims

Hello investers, is post me ham baat kar rahe hai un badi-badi headlins ki jo is baar ke budget me aayi – “12 lakh tak zero tax” jaisi lines sunne me bahut achhi lagti hai, lekin kya ye sabhi ke liye lagu hoti hai?

Is post me ham Income Tax Slabs India 2025 ko lekar faile bhram ko hatayege aur batayege ki kise wastav me fayda ho raha hai aur kise nahi.

Reality Check: Zero Tax Not for Everyone

Sabse badi headline hai – “12 lakh ta k zero tax” lekin yah puri sachchayi nahi hai.

Yah sabke liye applicable nahi hai – kuchh vishesh logo ke liye hi yah chhut hai.

Bahut se log nahi bata rahe ki rebbet kaise milega, kise milega, kis condition me milega aur kab tak milega.

Old Tax Regime ki baat lagbhag missing ho gayi hai. Is Post me ham in sab par saaf-saaf baat karege.

Know Your Tax Slabs: Old vs New Regime

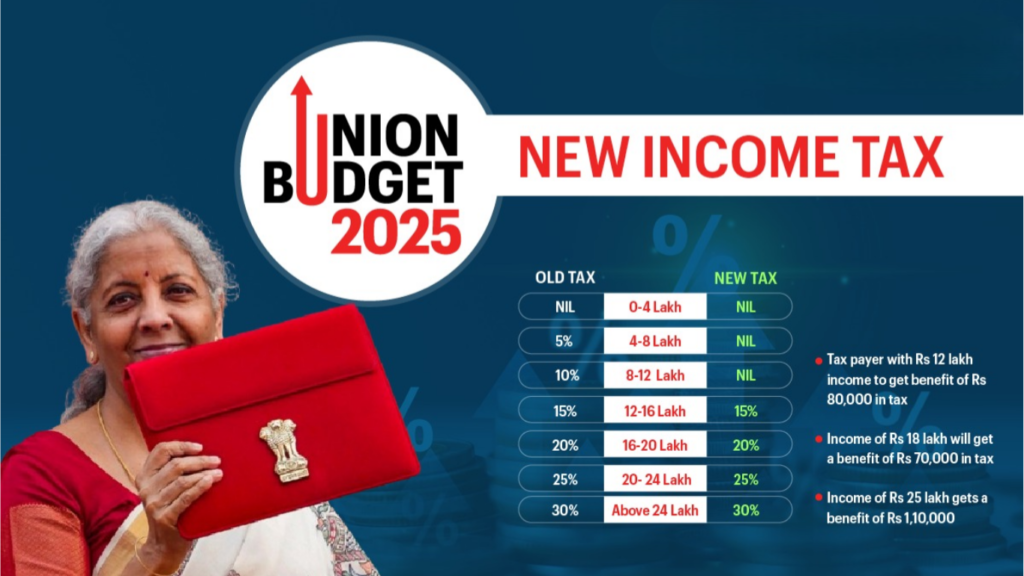

Sabse pahele, aapke screen ke samne hai tax slabs.

Pichhli baar ke mukable New Tax Regime me kuchh badlav huye hai jabki Old Regime me pichhle do-tin saal se koi badlav nahi hua hai.

Ab sarkar dhire-dhire Old Tax Regime ko irrelevant bana rahi hai. Pichhle saal tak 70% log New Tax Regime me aa chuke the.

Isliye ham maan shakate hai ki ab Income Tax Slabs India 2025 ke anusar New Regime hi age ka rasta hai.

The Confusion: Why Zero Tax Claims Exist

Yaha ek confusion hai. Agar slabs ke anushar 8 se 12 lakh me 10% tax hai, to fir aisa kyo kaha ja raha hai ki 12 lakh me 10% tax hai, to fir aisa kyo kaha ja raha hai ki 12 lakh tak koi tax nahi hai?

Iska karan hai rebbet.

Agar aapki salary 12.75 lakh tak hai aur aap salaried employee hai, to aapko tax slab ke hisab se to tax dena hoga, lekin sarkar aapko lagbhag 88000 tak ke benefits de rahi hai. Isme sabse bada hissa rebbet ka hai.

Who Gets Zero Tax? Here’s the Real Math

Agar aap salaried employee hai uar 12.75 lakh tak kamate hai, to sarkar aapko jitna tax dena hai utna hi rebbet de deti hai-

Iska matlab hai ki aapka effective tax rate zero ho jata hai.

Lekin agar aapki income 12.76 lakh ho jati hai – yaani Rs 1 jyada-to aapko pure slab ke hisab se tax dena hoga.

Yaani apko 4 se 8 lakh par 5%, 8 se 12 lakh par 10%, aur uske upar 15% tax dena padega. Rs 1000 jyada kamane par aapko Rs 62500 tak tax dena pad shakata hai.

Marginal Relief: The Government’s Fairness Adjustment

Sarkar ne is fark ko thoda fayar banane ke liye ek concept lagu kiya hai – Marginal Tax Relief. Is relief ki help se agar kisi ki salary 12.75 lakh se thodi jyada hai, to extra income ko penalty mankar wapas 12.75 lakh par laya jata hai.

Udaharn ke liye, agar income 13 lakh hai, to Rs 25000 ki penaly lagakar income ko 12.75 lakh mana jayega aur fir zero tax lagega.

Ye adjustment tab tak jari rahega jab tak aapki salary 62000 jyada nahi ho jati.

Income Bracket Wise Benefit Analysis

Ab aayiye dekhe ki Income Tax Slabs India 2025 ke anushar alag-alag salary bracket me aapko kitna fayda ho raha hai:

- 4 lakh tak: pahele bhi rebbet milta tha, ab to wese hi zero tax hai

- 8 lakh tak: pahele Rs 23000 tax dena padta tha, ab utni hi bachat hogi

- 12 lakh tak: Rs 71000 tak ki tax saving

- 16 lakh: pahele Rs 1.5 lakh dena padata tha, ab Rs 1.1 lakh – Rs 40000 ki bachat

- 20 lakh: pahele Rs 2.78 lakh tax, ab Rs 1.92 lakh- Rs 86000 ka benefit

- 24 lakh: Rs 1.1 lakh tak ki tax saving

- 30 lakh: pahele Rs 6 lakh, ab Rs 4.75 lakh- Rs 1.25 lakh ki bachat

Yah sabhi aankade dikhate hai ki Income Tax Slabs India 2025 me sabhi ko 25000 se Rs 1 lakh tak ka labh mil raha hai.

Free Tax Calculator to Know Your Savings

Agar aap apni exact savings janna chahte hai, to post me diye gaye free Finology ka tax calculater jarur istemal kare. Yah new regime ke anushar design kiya gaya hai.

Sirf salary dale aur aapko pata chal jayega ki aapko kitna fayda hua hai.

Missed Opportunity: Agricultural Income Loophole

Ab baat karte hai ek badi tax leakage ki – agricultural income.

Real kisano ko fayda milna chahiye, lekin kayi burocraters, actors, cricketers tax bachane ke liye kishan ki tarha register ho jate hai.

Sarkar ko isme crimi leyar avdharana lana chahiye. Jaise aam admi ke liye 12 lakh tak tax free hai, waise kisano ke liye 25 ya 50 lakh tak tax free kar de, lekin us se jyada kamane wale ko tax dena chahiye.

Unreasonable Slabs Create Tax Evaders

Kabhi-kabhi tax slab itne jyada ho jate hai ki logo ko tax chori ki taraf dhakelte hai. 1997 me ek slab me Rs 1 kamane par 97% tax dena padata tha.

Ab sarkar ne is par sudhar kiya hai aur Income Tax Slabs India 2025 me highest rate 39% rakha gaya hai. Lekin is se aur sudhar ki jarurat hai.

Optics Matter: India’s Global Tax Image

International optics ke liye bhi yah jaruri hai. Jab videshi invester bharat ko aankate hai, to sabse pahele highest tax rates ko dekhte hai.

Agar wo bahut jyada hai to bharat ko less business-friendly samaja jata hai.

Isliye Income Tax Slabs India 2025 me highest slab ko aur rationalize karna necessary hai.

Important Clarification: Special Income Not Covered

Ek aur aham baat- 12 lakh tak zero tax ka dawa har income par lagu nahi hota.

Agar aapki income me long term capital gains hai, to us par special rate lagta hai. Isliye 10 lakh salary aur 2 lakh capital gains me sirf salary par rebate milega, gains par nahi.

Conclusion: What You Must Know About Income Tax Slabs India 2025

Is post se saaf hai headlines ke pichhe ki sachchayi ko samajna jaruri hai.

Income Tax Slabs India 2025 me bhale hi sarkar ne kayi logo ko fayda diya hai, lekin kayi missed apportunity aur tax leakage bhi hai jinhe address karna baki hai.

Agar aap salaried hai aur aapki income 12.75 lakh tak hai, to aapko zero tax ka pura fayda mil shakata hai- basharte aap samajdari se new tax regime chune aur special income ko pahechane.

📌 FAQs on Income Tax Slabs India 2025

❓Q1: Kya 12 lakh tak ki income par sabhi ke liye zero tax hai?

Answer:

Nahi, yah puri sachchayi nahi hai. Yah sirf kuchh logo ke liye lagu hota hai. Income Tax Slabs India 2025 keaccording, yah rebate sirf unhi logo ko milega jo salaried employee hai aur jinki income 12.75 lakh tak hai. Agar aap independent professional hai ya khud ka business chalate hai, to 12 lakh tak tax free ki baat aapke liye thodi alag hogi. Sarkar 88000 tak ke benefits de rahi hai jisme major hissa rebate ka hia, jisse effective tax rate zero ho jata hai.

❓Q2: Agar meri income 12.76 lakh hai to muje kitna tax dena hoga?

Answer:

Agar aapki salary 12.76 lakh hai yani Rs 1 jyada, to aapko slab ke anushar pura tax dena hoga. Aapko 4 se 8 lakh par 5% 8 se 12 lakh par 10% aur uske upar ki income par 15% dena padega. Iska matlab yah hai ki Rs 1000 jyada kamane par aapko Rs 62500 tak tax dena pad shakata hai. Yahi karan hai ki Income Tax Slabs India 2025 mespastta avashyak hai.

❓Q3: Sarkar ne is unfairness ko kaise thik kiya hai?

Answer:

Sarkar ne is antar ko thoda santulit karne ke liye Marginal Tax Relief ka concept lagu kiya hai. Is me aapki income ko penalty ke rup me katkar wapas 12.75 lakh par laya jata hai taki aapko jyada tax na dena pade. Jab tak aapki salary 12.75 se lagbhag 62000 adhik nahi ho jati, tab tak sarkar yah adjustment lagu karti hai. Yah Income Tax Slabs India 2025 ke antargat fairness lane ki ek effort hai.

❓Q4: Agar meri income 13.25 lakh hai, to muje kitna labh milega?

Answer:

Agar aapki income 13.25 lakh hai, to sarkar Rs 50000 ki penalty legi aur aapki income ko 12.75 lakh mankar zero tax laga degi. Ye isiliye kiya jata hai taki aapki net income, 12.75 lakh wale vyakti se kam na ho jaye. Income Tax Slabs India 2025 meisefairness lane ke liye ek half-decent-solution ke rup me dekha ja shakata hai.

❓Q5: Kya har salary bracket kok tax me fayda mila hai?

Answer:

Haa, lagbhag sabhi bracket ko kuchh na kuchh tax benefit mila hai:

- 4 lakh tak: pahele bhi rebate miklta ha

- 8 lakh: ab Rs 23000 ki saving

- 12 lakh: Rs 71000 ki saving

- 16 lakh: Rs40000 ki saving

- 20 lakh: Rs 86000 ki saving

- 24 lakh: Rs 1.1 lakh tak ka benefit

- 30 lakh: Rs 1.25 lakh ka benefit

Yah sab Income Tax Slabs India 2025 ke badlavo ke karan huaa hai.

❓Q6: Kya is post me bataya gaya calculator sabhi ke liye faydemand hai?

Answer:

Haa, is post me diye gaye Finology ke free tax calculator ka prayog kar aap apni exact savings jan shakate hai. Yah calculator Income Tax Slabs India 2025 ke hisab se design kiya gaya hai aur free me uplabdh hai.

❓Q7: Kya agricultural income par tax nahi lagta?

Answer:

Nahi, agricultural income par tax nahi lagta aur yah loophole kayo non-farmers ke dhvara exploit kiya jata hai. Bueurocrets, acters, cricketers tax bachane ke liye kishan ki tarha register ho jate hai. Isliye Income Tax Slabs India 2025 me ye badi leakage hai,aur is par ek creamy layer ya slab lagu kiya jana chahiye.

❓Q8: Kya high income earners par tax jyada unfair haiहै?

Answer:

Haa, kabhi-kabhi tax slabs itne jyada ho jate hai ki imandar tax payer bhi tax chori ke liye majbur ho jate hai. 1997 me 97% tak tax deta padata tha. Ab ise ghatakar 39% kiya gaya hai. Fir bhi , Income Tax Slabs India 2025 mehighest tax slab ko aur rationalize karne ki jarurat hai.

❓Q9: Kya long-term capital gains par bhi rebate milega?

Answer:

Nahi. Agar aapki income me koi aisi income hai jo already special rate parr taxable hai – jaise ki long-term capital gains, to us par rebate lagu nahi hoga. Agar aapne 10 lakh salary kamayi aur 2 lakh capital gain se, to rebate sirf 10 lakh par milega. Income Tax Slabs India 2025 me yah ek important clarity hai.

❓Q10: Kya india ka tax structure investors ko attract karta hai?

Answer:

Jab international journals bharat ki business-friendliness ka aankalan karte hai, to we highest tax slabs ko dekhte hai. Agar yah jyada hai, to bharat ko non-investor friendly mana jata hai. Isliye Income Tax Slabs India 2025 meoptics bhi mahatvapurna bhumiya nibhate hai.

Register Here

📝Conclusion:

Income Tax Slabs India 2025 ko lekar faili bramit karne wali headlines ke pichhe ki sachchayi is post aur FAQs me saaf ki gayi hai. 12 lakh tak zero tax sabhi ke liye nahi hai-yah sirf kuchh salareid income walo ke liye rebate ke jariye sambhav hai. Saath hi, marginal tax relief, capital gains jaisi sharto aur missed opportunities ko bhi samjaya gaya hai. Yadi aap in badlavo ko samajkar sahi tax resime chunte hai, to aap adhik tax bacha shakate hai. Income Tax Slabs India 2025 me jagrukta hi asli bachat ka rasta hai.