🧠 Demat vs Trading Account Difference India | Best Account in India for Beginners (Complete Guide)

🔰 Introduction: Nivesh Ki Paheli Sidhi

Agar aapne is blogs post ko open kiya hai, to main asume kar raha hu ki aap market me investing ki shuruaat karne jaa rahe hai. Aur Main yahi puri koshish karuga ki aapki shuruaat ho, ek achhi wali shuruaat – With Finology, The Financial Fridom Company.

Aaj ham discuss karenge ki ye jo aapka pahla kadam market me hai na, ye akshar hota hai: Sahi Demat Aur Trading Account khulvana. To kaise aap sahi Brokar Chunege, kyoki trust bhi – ye jitna dikhta hai, usse kanhi jyada jaruri dicision hai.

📜 Mere Pahele Demat Account Ka Anubhav

Maine apna pahla Demat Account jab khulvaya tha aaj se 10-12 saal pahele, to discount brokers available nahi the. Brokerage bahut mahanga tha – shayad Rs 2000 se bhi jyada muje sirf account opening me lag gaye the.

Uske baad brokerage bhi bahut jyada tha. 32 signature lage the, ek moti buklate aayi thi jise mene sign kiya tha. Thankfully ab ye sab problem nahi hai. Account opening ab free hai, ya fir nominal amount par hai.

✅ Ab Kya Badala Hai?

- Koi lambe – lambe signature nahi

- Account opening 100% paper less

- Lekin ek nayi problem aa chuki hai — bahut saare option

Ab itne saare brokers hai ki Demat vs Trading Account difference hi logo ko samaj nahi aata. Confusion hai, Noise hai. Aise me agar aap Beginner hai – Main yaha hu aapko guide karne ke liye.

🧩 Demat vs Trading Account Difference: SabseImportant Sawal

Ab sabse pahele to ham teen shabd sunte hai jab bhi ham account khulvane ki sochte hai:

- Demat Account

- Trading Account

- Brokerage Account

Kya ye teeno ek hi chiz hai? Nahi! yahi hai Real Demat vs Trading Account difference।

📦 Demat Account Ka Matlab

1996 ke pahele tak physical share hote the. jalne , chori hone, gila hone jaisi kayi samasyaye thi. Kayi companiya duplicate share bi issue karti thi.

Jab share Digital ho gaye, to Dematerialised yani Demat kahlane lage. Yaani share ab digital form me stor hote hai.

👉 Agar kisi ko fir se physical shares chahiye hote the, to use Re-mat kaha jata hai.

💼 Trading Account Ki Bhumika

Yaha se Demat vs Trading Account difference Aur more clean hota hai.

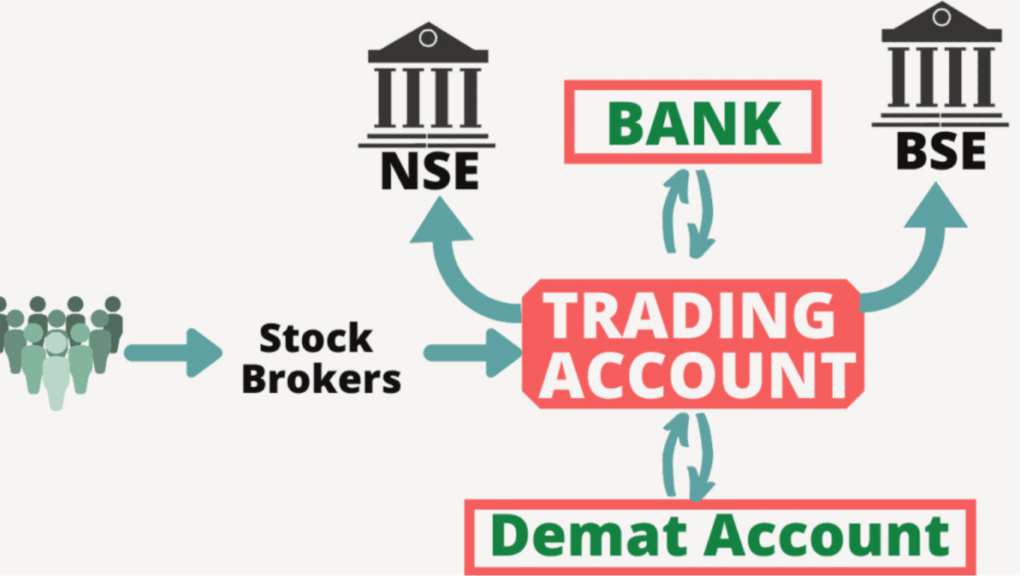

Jab bhi aapko stocks kharidne-bechane hote hai, to aapko dono account kholne padte hai:

- Ek Trading Account — jo aap apne broker ke paas kholte hai

- Aur ek Demat Account — jo NSDL ya CDSL jaisi depositary ke sath khulta hai

Trading Account sirf Exchange ke liye hota hai. aapka portfolio — yani shares— Demat Account me rahete hai.

🔐 Broker Doob Jaaye To Kya Hoga?

SEBI ne niyam banaye hai ki aapke share broker ke paas nahi, balki Demat Account me rakhe jaye.

👉 Isliye agar aapka broker doob jaye to aap bas kisi aur broker ke paas jakar apne purane Demat Account ko naye trading account se link kar shakte hai.

ye bhi Demat vs Trading Account difference ka ek bada fayda hai – aapka portfoliyo surkshit rahna hai.

💡 Demat vs Trading Account: Beginners Kya Dhyan Rakhe?

Ab aate hai Beginners ke liye jaruri points par, jab aap paheli baar account khol rahe hai:

❌ Avoid Free Tips Brokers

Kuchh brokers aapko free me Trading Tips denge. Lekin unka munafa tabhi hota hai jab aap baar-baar trade kare. Isse aapka nukshan ho shakata hai.

⚠️ F&O Account Se Bache

Futures & Options bahut riski hota hai.Sirf Equity Account se shuruaat kare.

🛡️ Trusted Broker Chune

Zerodha jaise trusted brokers me galti karne se pahele hi warning milti hai – jaise penny stocks, unsaif shares ityadi.

💸 Hidden Charges Aur Real Cost

Account khulvate waqt sirf opening charge hi nahi , aapko ye bhi dekhna chahiye:

- Annual Maintenance Charges (AMC)

- Brokerage Charges

- Hidden Taxes

👉 Zerodha me Rs 20 se jyada brokerage nahi lagta, jab ki HDFC jaise full-service brokers me 2.5% tak lag shakata hai.

Isliye Demat vs Trading Account difference samajna aur sahi account chunna, long term me bahut paisa bacha shakata hai.

📊 Brokerage Comparison Tools

Select.in jaise plateforms par aap:

- Alag-alag brokers ka Comparison kar shakate hai.

- Brokerage Calculator Chala shakate hai.

- F&O aur Delivery Charges dekh shakate hai.

📋 Step-by-Step Broker Picker Tool

Select.in ke “Find My Broker” section me sirf 30 second me ye tay ho jata hai ki:

- Aapko kaun sa Broker soot karega

- Aapke liye AMC chahiye ya nahi

- Margin, Mutual Funds jaisi suvidhaye milegi ya nahi

Aur ye sab bina brokers se call kiye, transparent tarike se!

📥 Account Opening Guide & Resources

Agar aap Zerodha jaise trusted broker ka Demat Account kholna chahte hai:

- Google Play par Zerodha search kar ke install kar shakte hai

- Document checklist download kare

- Ek ashan video guide bhi uplabh hai- jo step by step puri prakriya samjata hai.

📌 Demat vs Trading Account Difference Ko Samje Aur Surakshit Shuruaat Kare

Is blog post me hamne sikha:

- Demat vs Trading Account difference kya hai

- Kis account me aapke share surakshit rahte hai

- Sahi broker kaise chune

- Hidden charges kaise bache

Agar aap Beginner hai, to sahi shuruaat bahut jaruri hai. Aur sahi shuruaat hoti hai — Demat vs Trading Account difference ko samajne se.

💬 Kya AApne Sahi Broker Chuna?

Agar aapko ye blog post helpful lagi ho, to comment me batayiye:

- Aapne kaun sa broker chuna?

- Aapko kis point ne sab se jyada madad ki?

❓ (FAQ) Aksar Puchhe Jane Wale Sawal — Demat vs Trading Account difference

🔹 Q1. Kya Demat Account Aur Trading Account Ek Hi Hote Hai?

Nahi, yahi sabse bada Demat vs Trading Account difference hai.

Demat Account me aapke kharide gaye share डिजिटल फॉर्म में सुरक्षित रखे जाते हैं, jabki Trading Account keval len-den (buy/sell) ke liye hota hai.

Trading Account aap apne broker ke paas kholte hai, jabki Demat Account NSDL ya CDSL jaisi depositer ke sath khulta hai.

🔹 Q2. Agar Broker Doob Jaye To Mere Share Ka Kya Hoga?

SEBI ke niyamo ke anushar, broker sirf Trading ka Madhyam hota hai. Aapke share Demat Account me rakhe jate hai. Agar broker band ho jaye, to aap apne Demat Account koi kisi naye Trading Account se link kar shakte hai. Ye ek bahut bada fayda hai aur yahi wajah hai ki Demat vs Trading Account difference ko samajna jaruri hai.

🔹 Q3. Kya Muje Do Alag-Alag Account Kholne Hoge?

Jyadatr mamlo me jab aap kisi broker ke paas jate hai, to wah ek sath hi Demat और Trading Account dono khulva deta hai.

Demat Account banand par NSDL/CDSL ke jariye khulta hai aur Trading Account broker ke sath.Isliye aapko technicaly dono account ki jarurat hoti hai.

🔹 Q4. Kya Brokerage Account Bhi Alag Hota Hai?

Brokerage Account asal me Trading Account hi hota hai.Yah bas ek alag shabdavli hai. Isliye jab koi kahe ki “Muje Brokerage Account kholna hai”, to wah asal me Trading Account hi khol raha hai.

🔹 Q5. F&O Account Kya Hai Aur Kya Muje Use Bhi Kholna Chahiye?

F&O matlab Futures & Options — yah high risk segment hota hai.

Agr aap Beginner hai to aapko sirf Equity Trading Account kholna chahiye.

F&O account khulvane ke liye alag se अकाउंट खुलवाने के लिए अलग से income proof, net worth certificate jaisi details deni padati hai.

🔹 Q6. Muje Kis Tarha Ka Broker Chunna Chahiye?

Aapko aisa broker chunna chahiye jo:

- Trusted aur Proven ho (jaise Zerodha)

- Galat stocks par aapko warn Karta ho

- Faltu ke trading calls aur tips na bheje

- Hidden Charges na lagaye

Demat vs Trading Account difference ke sath-sath sahi broker chunna aapke liye long-term me paisa aur sirdard dono se bacha shakata hai.

🔹 Q7. Kya Zerodha Jaise Discount Broker Surakshit Hai?

Haan, Zerodha jaise discount broker student aur technology par adharit hai.

Inme ek bada benefits yah hai ki:

- Rs 20 se jyada brokerage nahi lagta

- Platform user friendly hota hai

- Jarurat se jyada plans nahi hote — ek hi plan hota hai.

Ye cheeze Demat vs Trading Account difference ko samajne aur sahi decision lene me madad karti hai.

🔹 Q8. Hidden Charges Kya Hote Hai Aur Kaise Bache?

Demat aur Trading Account kholte samay aapko dhyan dena chahiye:

- Annual Maintenance Charges (AMC)

- Per Transaction Brokerage

- GST, SEBI Charges

- Hidden Platform Fees

Brokerage Calculator ka use kar ke aap alag-alg broker ka kharch compare kar shakte hai.

🔹 Q9. Kya Kisi Website Se Best Broker Compare Kiya Ja Shakata Hai?

Haan, aap select.in jaise plateforms par jakar:

- Brokers ki fetures tulna kar shakte hai

- Brokerage Calculator se fix Charges dekh shakate hai

- “Find My Broker” tool se 30 second me personal recommendation paa shakate hai

Yah transparency aapko Demat vs Trading Account difference ke sath-sath sahi decision lene me help karta hai.

🔹 Q10. Account Opening Ke Liye Kaun-Kaun Se Documents Lagate Hai?

- Adhar Card

- PAN कार्ड

- Ek Selfie

- Ek Cancelled Cheque ya Bank Proof

- Signature (digital ya scan)

Aapko sab kuchh online hi upload karna hota hai. Jyadatar process ab 100% paperless hota hai.

🔹 Q11. Kya Mutual Funds Me Bhi Demat Account Ki Jarurat Hoti Hai?

Jaruri nahi, lekin kay ibroker jaise Zerodha aapko apne Demat Account ke jariye Mutual Fund me bhi invest karne ki suvidha dete hai.

Agar aap single-window investment pasand karte hai, to yah bhut convenient ho shakata hai.

🔹 Q12. Kya Naya Broker Chunte Samay Kisi Ek Cheez Ka Khaas Dhyan Rakhna Chahiye?

Haan — Trust se kabhi samjota na kare.

Sirf sabse sasta ya aggressive marketing wale broker ke chakkar me na pade.

Aise broker ke platforms aksar immature hote hai aur glitches hote hai.

Demat vs Trading Account difference tabhi mayne rakhta hai jab aapka chosen broker khud trusted ho.

🔹 Q13. Zerodha Me Account Kaise Khole?

- Google play se download kar shakte hai

- Documents taiyyar rakhe

- Step-bay-step video guide dekhe

- Account puri tarha free aur paper less tarike se khulega

🔹 Q14. Kya Ek Hi Demat Account Ko Kayi Brokers Se Joda Ja Shakata Hai?

Ji Haan.

Agar aapka ek Demat Account NSDL/ CDSL me hai, to aap use kisi bhi naye Trading Account se link kar shakte hai.

Yahi wajah hai ki jab tak Demat vs Trading Account difference samajte hai, aap jyada surakshit mahsus karenge.

🔹 Q15. Kya Muje Do Broker Ke Sath Account Kholna Chahiye?

Aap chahe to khol shakte hai, lekin Beginners ke liye ek trusted discount broker paryapt hota hai.

Also Read >>>The Biggest Investment Mistake: Yes Bank Se Sikhi 5 Anmol Baate

📌 Conclusion:

Demat vs Trading Account difference ko samajna invest ki majbut shuruat ke liye behat jaruri hai. Sahi broker, kam charges aur surakshit plateform chunkar aap long term me bada fayda kama shakte hai. Beginners ke liye ye jankari samay aur paisa dono bacha shakati hai.

Aur Haan- Post ko share karna bilkul bhi mat bhuliyaga.

Let’s help every beginner invest wisely! 🚀